Homes nationwide are expected to gain almost $1.9 trillion in cumulative value in 2013, the second consecutive annual gain and the largest since 2005, according to an analysis of Zillow® Real Estate Market Reports.

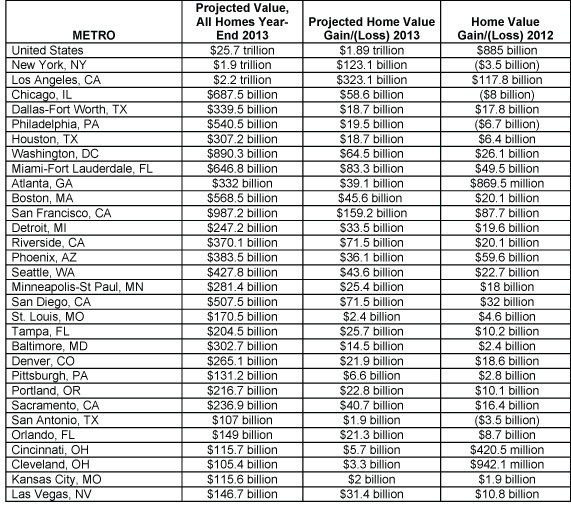

Gains were calculated by measuring the difference between cumulative home values as of the end of 2012 and anticipated cumulative home values at the end of 2013. The overall value of all homes in the U.S. at the end of 2013 is expected to be approximately $25.7 trillion, up 7.9 percent from the end of 2012. Last year, cumulative home values rose 3.9 percent from 2011.

The gain in cumulative home values is the second annual gain in a row, after home values fell in every year from 2007 through 2011. Between 2007 and 2011, the total value of the U.S. housing stock fell by $6.3 trillion. Over the past two years, U.S. homes have gained back $2.8 trillion, or about 44 percent of the total value lost during the recession.

“In 2013, the housing market continued to build on the positive momentum that began in 2012, after the housing market bottomed. Low mortgage rates and an improving economy helped bring buyers into the market, boosting demand and driving prices up,” said Zillow Chief Economist Stan Humphries. “We expect these gains to continue into next year, though at a slower pace. The housing market is transitioning away from the robust bounce off the bottom we’ve been seeing, toward a more sustainable, healthier market. This will result in annual appreciation closer to historic norms of between 3 percent and 5 percent.”

Almost 90 percent of the 485 total metro areas analyzed nationwide experienced home value gains in 2013. Of the 30 largest metros, those with the largest gains in overall value as measured by total dollar volume include Los Angeles ($323.1 billion), San Francisco ($159.2 billion), New York ($123.1 billion), Miami ($83.3 billion) and San Diego ($71.5 billion).

For more information, visit Zillow.com.

Realtor® University Happenings: The course, “A Consumer Advocate Approach to Real Estate & Mortgages” has been created to help you go from “real estate agent” to “Real Estate Professional.” Find out more here.