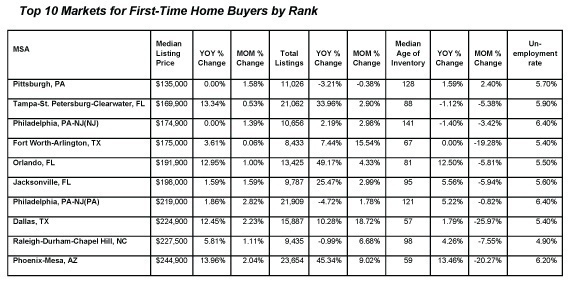

Realtor.com®, a leader in online real estate operated by Move, Inc., has released the Top 10 Markets for First-Time Home Buyers for the upcoming home buying season. Markets that made the 2014 list by rank include: Pittsburgh, PA; Tampa-St. Petersburg-Clearwater, FL; Philadelphia, PA; Fort Worth-Arlington, TX; Orlando, FL; Jacksonville, FL; Dallas, TX; Raleigh-Durham-Chapel Hill, NC and Phoenix-Mesa, AZ.

Realtor.com®, a leader in online real estate operated by Move, Inc., has released the Top 10 Markets for First-Time Home Buyers for the upcoming home buying season. Markets that made the 2014 list by rank include: Pittsburgh, PA; Tampa-St. Petersburg-Clearwater, FL; Philadelphia, PA; Fort Worth-Arlington, TX; Orlando, FL; Jacksonville, FL; Dallas, TX; Raleigh-Durham-Chapel Hill, NC and Phoenix-Mesa, AZ.

“As we head into home buying season, these markets show favorable conditions for first-time buyers, which is encouraging because these buyers are crucial to the housing market,” said Steve Berkowitz, CEO of Move, Inc. operator of realtor.com. “First-time buyers have a widespread impact on the local housing markets. In transitioning from renters to owners, new buyers pay property taxes and other fees and taxes associated with homeownership that benefits local schools and services.”

Market dynamics play a major role in the level of stress taken on by buyers, especially to buyers new to the process. In this report, realtor.com® examined five key factors including market popularity, prices, inventory, time on market and employment, to see which markets currently are the best for new buyers.

1. Location, location, location: Market popularity is an important consideration for first-time buyers. It is common for owners to become “move up” buyers and purchase a larger home a few years after a first home purchase. Buying a home in popular markets increases the likelihood of making money on a first home.

2. Affordable list prices: One of the biggest barriers to homeownership is affordability. Home owners not only have to be able afford a monthly mortgage payment, but have enough saved for a down payment. Less expensive homes are typically a better fit for first-time buyers as they require less of a down payment and have lower monthly mortgage payments.

3. Supply of inventory: Inventory shortages can often spark bidding wars between buyers where investors or buyers with more income can price out first-time buyers. Markets with a steady supply of inventory are less likely to involve bidding wars.

4. Reasonable time on market: Median age of inventory is a clear indicator of demand in a market. High demand is another factor that prompts bidding wars and makes it difficult for first timers to get the home of their dreams. Additionally, first-time home buyers should consider the specific amount of time a home that has been on the market, they may have an opportunity for a better deal as sometimes sellers are required to price homes more competitively in order to close.

5. Steady employment: Unemployment rates affect all aspects of the economy, including first-time buyers. In order to pay for their mortgages, new buyers need to work and hold steady jobs in markets that support their job.

Methodology: realtor.com® examined key housing indicators including: search rank, median list price, year-over-year change in inventory, median age of inventory and unemployment rates across 146 markets and evaluated the metrics against the needs and desires of the typical first-time home buyer. All metrics considered were pulled directly from realtor.com® February 2014 data and the U.S. Bureau of Labor Statistics.

Realtor.com® regularly tracks real estate data and develops monthly reports featuring the number of listings, median age of inventory and median list price across the U.S. and in specific markets, as well as provides year-over-year and month-over-month changes. These reports are the only ones pulled directly from the realtor.com® database, where 90 percent of listings are updated every 15 minutes from more than 800 MLSs. We regularly review and update historical data in order to provide the most accurate and comprehensive market information available. For more information on Move, please visit www.move.com or one of its many online real estate properties including realtor.com®.