Nationally, 13 percent of surveyed consumers are ready to buy a luxury home and another 26 percent are considering a high-end home purchase, according to the Luxury Homebuyer Survey recently conducted by realtor.com®, a leader in online real estate operated by Move, Inc.

Nationally, 13 percent of surveyed consumers are ready to buy a luxury home and another 26 percent are considering a high-end home purchase, according to the Luxury Homebuyer Survey recently conducted by realtor.com®, a leader in online real estate operated by Move, Inc.

Survey data reveals the buying motivations of transaction-ready consumers and others considering purchase, as well as provides insight into their preferred luxury property amenities and resale expectations. Realtor.com® surveyed more than 1,500 visitors to its website from March 17 to April 2.

Percentages of surveyed consumers currently considering a luxury home purchase:

o 13% of respondents stated that they are looking to purchase a high-end luxury home;

o 26% said they might be considering a high-end luxury home;

o 61% revealed they are not looking for a high-end luxury home.

Most popular price points at which surveyed consumers stated that luxury housing begins, by U.S. regions:

o Northeast (ME, VT, NH, NY, NJ, MA, CT, RI, MD, DE, PA) $1 million +

o Pacific (CA, OR, WA, AK, HI) $1 million +

o Mountain (MT, ID, WY, CO, UT, NV, AZ, NM) $1 million +

o South Central (AL, MS, TN, AR, LA, TX, OK) $500,000 +

o North Central (KY, OH, IN, IL, MI, WI, MN, IA, NE, KS, ND, SD) $500,000 +

o South Atlantic (VA, WV, NC, SC, GA, FL) $500,000 +

“The luxury homebuyer is an important contingent of today’s real estate market, as luxury homes tend to drive trends throughout the entire balance of the marketplace,” said Barbara O’Connor, chief marketing officer for Move, Inc. “We are seeing large portions of buyers throughout the country—from 23 percent in the Northeast region and 23 percent in the South Atlantic—eyeing luxury homes. This means sellers, builders, and certainly REALTORS® should all pay particular attention to desired luxury amenities such as chef-quality kitchens and master suite features to close deals for them.”

Of the survey respondents who are currently looking for a luxury home:

o Most popular reasons high-end buyers started their luxury home search:

o 19% said recent career success prompted their luxury home search;

o 17% entered the market because they recently retired;

o 14% got into the market as an investment; and

o 12% entered the market to buy their first home.

o Biggest challenges of searching for a high-end luxury home:

o 40% of luxury buyers cited finding a property that meets their family’s needs;

o 20% shared their biggest challenge is the limited number of properties offered;

o 11% tout ultra-unique properties with limited universal appeal; and

o 8% are challenged by gaining access to mortgage loans.

o Most important home features when considering a luxury purchase:

o 54% of luxury buyers indicated a chef’s kitchen as an important feature;

o 44% consider the home’s views of oceans, mountains or cityscapes as significant;

o 38% responded that the square footage of the property is a key attribute; and

o 36% included the presence of an expansive master suite as an important factor.

o Importance of resale value to those in the market for a luxury home:

o 35% indicated it is very important;

o 29% shared it is neither important or unimportant;

o 27% of luxury buyers said resale value is extremely important; and

o 8% consider resale value to be unimportant.

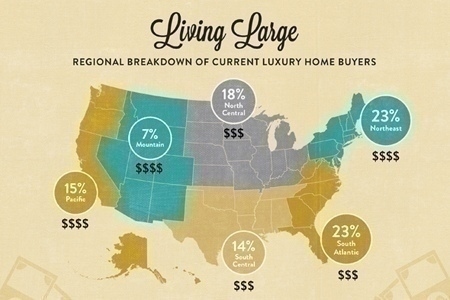

o Regional breakdown of current luxury home buyers’ locations:

o 23% South Atlantic (VA, WV, NC, SC, GA, FL);

o 23% Northeast (ME, VT, NH, NY, NJ, MA, CT, RI, MD, DE, PA);

o 18% North Central (KY, OH, IN, IL, MI, WI, MN, IA, NE, KS, ND, SD);

o 15% Pacific (CA, OR, WA, AK, HI);

o 14% South Central (AL, MS, TN, AR, LA, TX, OK); and

o 7% Mountain (MT, ID, WY, CO, UT, NV, AZ, NM).

Of the survey respondents who are NOT in the market for a luxury home:

o If respondents had an extra million dollars to invest in a home, they would use it in the following ways:

o 28% would sell their current home and purchase a new one;

o 23% would keep their current home and purchase either a new or vacation home;

o 14% would purchase several homes; and

o 14% would buy their first home.