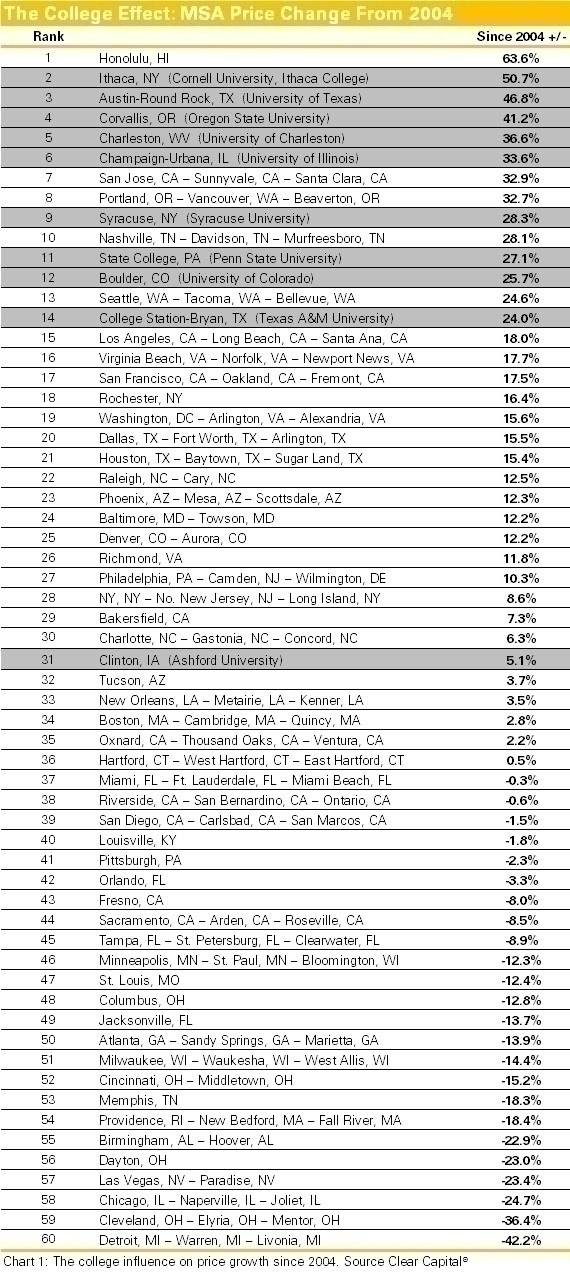

Clear Capital recently released its Home Data Index™ (HDI) Market Report with data through October 2014, which looked at the way colleges and universities are having an effect on housing across the country. Metros with noteworthy university influence are at the top of their class, with home price trends far outperforming national rates of growth since 2004. A sample of 10 metros (Chart 1), each having a university presence, shows an average growth of 32 percent since 2004. Considering national home prices have only now climbed back up to 2004 price levels following nearly three years of recovery, these college towns have performed remarkably well. Their immunity to the boom-bust-bubble cycle proves these markets are unique in their sustained housing demand.

Clear Capital recently released its Home Data Index™ (HDI) Market Report with data through October 2014, which looked at the way colleges and universities are having an effect on housing across the country. Metros with noteworthy university influence are at the top of their class, with home price trends far outperforming national rates of growth since 2004. A sample of 10 metros (Chart 1), each having a university presence, shows an average growth of 32 percent since 2004. Considering national home prices have only now climbed back up to 2004 price levels following nearly three years of recovery, these college towns have performed remarkably well. Their immunity to the boom-bust-bubble cycle proves these markets are unique in their sustained housing demand.

Sustained gains at the MSA-level are a direct benefit of metros with heavy college influences. The Ithaca MSA, home to Cornell University and Ithaca College, has seen home prices rise a stunning 51 percent since 2004, putting the metro at the head of the class nationally. And it’s not just metros in the Eastern Region seeing college pay off. In Boulder, home to the University of Colorado, home prices are up an impressive 26 percent since 2004. These markets each maintain a foundation of sustained demand from students hungry for an education and in need of a roof over their heads.

Even larger MSAs with a heavy academic focus, like Boston, are seeing impressively strong micro market growth. Cambridge housing demand from students attending Harvard University has helped fuel price growth of 39 percent over the last decade. The University’s ZIP code 02183 has outperformed the Boston MSA by 36 percent since 2004, highlighting the noteworthy influence of academia on local home prices. There’s no question that the many universities within this area, including MIT, contribute to the unique demand in the Cambridge, MA ZIP code and surrounding areas.

The symbiotic relationship between university life and home prices, however, is localized. Now a full year into a cooling recovery, stronger demand from first-time homebuyers is a prerequisite to a sustainable recovery as investor demand dwindles. College graduates who feel confident enough in their employment prospects and the housing market to attempt to qualify for a mortgage will have to grapple with an average of more than $30,000 in existing student debt. With student debt now in excess of $1 trillion and growing, the housing market faces demand headwinds at a crucial transitional point in the recovery.

“College towns are just another example of how real estate trends are impacted by local market conditions” says Dr. Alex Villacorta, vice president of research and analytics at Clear Capital. “It’s clear a significant portion of loan dollars are going towards student housing costs, thereby creating a critical demand surge. Healthy student populations activate a positive feedback loop where housing fuels local economies and jobs which increase the overall confidence and demand in these towns. Concerns over rising student debt and recent college graduates’ ability and desire to qualify for a home loan could certainly create a drag on the recovery overall as the next phase depends on re-engagement by traditional homebuyers. Generally, investment opportunity in college markets yield benefits that ripple beyond localized home price strength since higher education typically begets higher income which has allowed more folks to invest in the American Dream. While this is still true today, the struggle between rising student debt and a first-time homebuyer’s desire and ability to qualify for a mortgage will pose an interesting challenge for the future of the recovery. We’ve now seen a full year of moderating price growth at the national level. The concern now is less about declining gains, and more in the market’s ability to stabilize once we hit that range. As we see investment demand and distressed sale activity transition back to a level more in line with historical averages, we need to see demand from traditional homebuyers ramp up. The first-time homebuyer segment is a key portion of this demand segment, but their desire and ability to offset the housing demand gap in today’s environment remains to be seen.”

For more information, visit www.clearcapital.com.