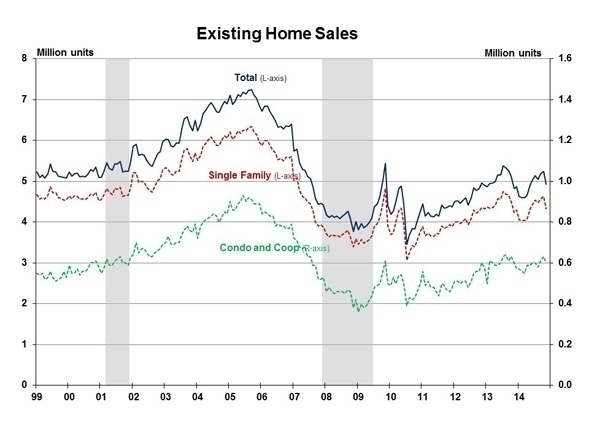

Although existing home sales decreased in November, the share of sales for first-time buyers increased to the highest level since October 2012. Existing home sales decreased 6.1 percent in November, but were 2.1 percent above the same period a year ago. The National Association of REALTORS (NAR) reported November 2014 total existing home sales at a seasonally adjusted rate of 4.93 million units combined for single-family homes, townhomes, condominiums and co-ops, down from a downwardly revised 5.25 million units in October.

Although existing home sales decreased in November, the share of sales for first-time buyers increased to the highest level since October 2012. Existing home sales decreased 6.1 percent in November, but were 2.1 percent above the same period a year ago. The National Association of REALTORS (NAR) reported November 2014 total existing home sales at a seasonally adjusted rate of 4.93 million units combined for single-family homes, townhomes, condominiums and co-ops, down from a downwardly revised 5.25 million units in October.

Existing sales were down from last month in all four regions, ranging from 3.2 percent in the South to 9.6 percent in the West. Year-over-year, the South and North increased by 5.0 percent and 4.6 percent respectively. The West and Midwest decreased slightly from last year by 1.0 percent and 1.7 percent respectively.

The first-time buyer share increased to 31 percent in November from 29 percent in October. The November first-time share was the highest since the 31 percent level reported in October 2012. The first-time buyer share was 29 percent through eleven months of 2014. Reports of easing mortgage standards will help first-time buyers, and a full recovery awaits their return to their typical 40 percent share.

Total housing inventory decreased 6.7 percent in November to 2.09 million existing homes. At the current sales rate, the November 2014 inventory represents a 5.1-month supply, unchanged from last month. NAR also reported that in November the typical time on the market increased to 65 days, compared to 63 days in October, 56 days in September, 53 days in August and 56 days during the same period a year ago. NAR reported that 32 percent of homes sold in November were on the market less than a month, compared to 33 percent of homes sold in October, 35 percent in September and 40 percent the prior two months.

The November distressed sales share remained unchanged at 9 percent, and has been below 10 percent for four of the past five months. Distressed sales are defined as foreclosures and short sales sold at deep discounts. November all cash sales decreased to 25 percent of transactions, down from 27 percent in October and 32 percent during the same month a year ago. Individual investors purchased a 15 percent share in November, unchanged from October, but down from 19 percent in November 2013. Some 61 percent of November investors paid cash, compared to 65 percent in October and 69 percent in the summer during June and July. The gradual withdrawal of cash investors will create more opportunity for first-time buyers.

The median sales price decreased for the fifth consecutive month in November to $205,300 compared to a revised $207,500 in October. However, the November median sales price was 5.0 percent above the same period a year ago, and represented the 33rd consecutive month of year-over-year price increases. The median condominium/co-op price decreased to $199,000 in November from $203,900 in October, and was up 1.2 percent from the same period a year ago.

The Pending Home Sales Index decreased 1.1 percent in October, suggesting a pause in momentum for existing sales. But the uptick in the first-time buyer share was good news for that lagging segment of the market.

This post was originally published on NAHB’s blog, Eye on Housing.