In the first five months of 2015, potential returns from buy-to-rent purchases of 3-bedroom residential properties decreased from the same time period a year ago in 59 percent of counties analyzed, according to a recently released RealtyTrac® Buy-to-Rent analysis. The analysis, coupled with a Buy-or-Rent analysis, focused on 3-bedroom residential properties in 285 counties nationwide.

In the first five months of 2015, potential returns from buy-to-rent purchases of 3-bedroom residential properties decreased from the same time period a year ago in 59 percent of counties analyzed, according to a recently released RealtyTrac® Buy-to-Rent analysis. The analysis, coupled with a Buy-or-Rent analysis, focused on 3-bedroom residential properties in 285 counties nationwide.

Across all 285 counties analyzed, the average potential annual gross rental yield was 8.94 percent for 3-bedroom residential properties purchased in the first five months of 2015, down from a 9.07 percent potential average potential rental return for 3-bedroom residential properties purchased in the same time period a year ago in those same counties.

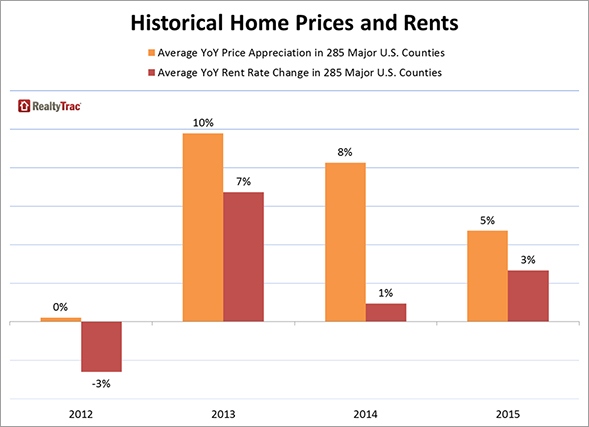

“As home price appreciation moderates and aligns more closely with trends in rental rates, the returns in the buy-to-rent market are stabilizing and becoming more predictable — if not as lucrative as they were for investors who purchased a few years ago near the bottom of the market,” says Daren Blomquist, vice president at RealtyTrac. “Buying rentals continues to be a brilliant strategy that allows investors to hedge their bets in a real estate market shifting away from homeownership and toward a sharing economy.”

Average rental rates on 3-bedroom properties increased 3 percent from a year ago across all 285 counties analyzed, while average home prices on 3-bedroom properties increased 4 percent across those same counties.

Counties with increasing buy-to-rent returns

Potential buy-to-rent returns still increased in 116 of the 285 counties analyzed (41 percent) thanks to rental rate growth outpacing home price growth in those counties. Major counties where potential buy-to-rent returns increased from a year ago included Orange County, California in the Los Angeles metro area, King County, Washington in the Seattle metro area, Santa Clara County, California in the San Jose metro area, Philadelphia County, Pennsylvania, and Suffolk County, New York on Long Island.

Other major markets with year-over-year increases in potential buy-to-rent returns included counties in Cincinnati, Cleveland and Columbus in Ohio, Atlanta, Charlotte and Raleigh in North Carolina, Milwaukee, Jacksonville, Florida, Seattle and Denver.

Best counties for buy-to-rent returns

Counties with the highest potential rental returns for 3-bedroom properties purchased in the first five months of 2015 were Clayton County, Georgia in the Atlanta metro area (24.05 percent annual gross rental yield), Bay County, Michigan in the Bay City metro area (19.23 percent), Mahoning County, Ohio in the Youngstown metro area (19.04 percent), Bibb County, Georgia in the Macon metro area (18.11 percent), and Philadelphia County, Pennsylvania (17.67 percent).

There were 51 counties with a combined population of 18.5 million where potential buy-to-rent returns were 10 percent or higher and where average weekly wages in the fourth quarter of 2014 increased 3 percent or more from a year ago. These counties included Wayne County, Michigan in the Detroit metro area (15.50 percent annual gross rental yield), Cuyahoga County, Ohio in the Cleveland metro area (14.62 percent), Milwaukee County, Wisconsin (12.15 percent), Erie County, New York in the Buffalo metro area, and Duval County, Florida in the Jacksonville metro area (13.39 percent).

Best zip codes for buy-to-rent returns

RealtyTrac also analyzed potential buy-to-rent returns in 4,657 zip codes with sufficient fair market rent and home price data in the first five months of 2015.

Zip codes with the highest potential rental returns on 3-bedroom properties purchased in the first five months of 2015 included zip codes in the Detroit, Atlanta, Cleveland, Philadelphia, Jacksonville, Florida, and Memphis metro areas. There were a total of 105 zip codes with a gross annual rental yield of 18 percent or higher.

Buying more affordable than renting in 66 percent of counties

The separate Buy-or-Rent analysis released today found that making monthly house payments on a 3-bedroom property is more affordable than paying fair market rent on a 3-bedroom property in 188 of the 285 counties analyzed (66 percent).

The Buy-or-Rent analysis compared the percentage of median household income in each county that would be needed to pay the fair market rent on a 3-bedroom property in that county to the percentage of median household income that would be needed to make monthly house payments — including mortgage, insurance and property taxes — on an average-priced 3-bedroom property in that county.

Across all 285 counties analyzed, the average percentage of median household income needed to rent was 29.96 percent while the average percentage of median household income needed to buy was 29.00 percent.

Counties more affordable to buy than rent

Major counties where it is still cheaper to buy than to rent include Miami-Dade County, Florida (42 percent of income to buy), San Bernardino County, California in Inland Southern California (36 percent), Clark County, Nevada in the Las Vegas metro area (27 percent), Broward County, Florida in South Florida (35 percent), and Wayne County, Michigan in the Detroit metro area (23 percent).

“The window is wide open for renters to take advantage of homeownership in South Florida today,” says Mike Pappas, CEO and president of Keyes Company, covering the South Florida market. “Rents have skyrocketed over the past few years and may be peaking, while interest rates are still at historic lows. With the tax savings from interest and real estate tax payments a tenant can own for less than they are currently paying in rent.”

There were 13 counties where it was more affordable to buy in 2015 that had been more affordable to rent in 2014. Those counties included Snohomish County, Washington in the Seattle metro area, Berks County, Pennsylvania in the Reading metro area, Hamilton County, Indiana in the Indianapolis metro area, Thurston County, Washington in the Olympia metro area and Warren County, Ohio, in the Cincinnati metro area. Other markets switching from more affordable renter markets in 2014 to more affordable buyer markets in 2015 included counties in Cedar Rapids, Iowa, Cleveland, Ohio, Albany New York and The Villages in central Florida.

“In Seattle, a considerable number of single family home renters are made up of people who lost their own homes to foreclosure,” says Matthew Gardner, chief economist at Seattle’s Windermere Real Estate. “As these ‘boomerang’ buyers are able to requalify for mortgages, I expect many of them will settle in areas outside of Seattle, like Pierce and Snohomish Counties, where the average monthly mortgage payment is lower than rent.”

Counties more affordable to rent than buy

Renting is more affordable than buying in 97 of the 285 counties analyzed (34 percent). Major counties where it is cheaper to rent than to buy include Los Angeles, California (69 percent of median household income needed to buy), San Diego, California (56 percent), Orange, California (57 percent), Riverside County, California in Inland Southern California (43 percent), King County, Washington in the Seattle metro area (45 percent), and Denver County, Colorado (51 percent).

“We are finding many first time homebuyers in a short-term-versus-long-term quandary along the Front Range in Colorado,” says Greg Smith, owner/broker of Denver’s RE/MAX Alliance. “In today’s market many buyers are not willing to take the leap to increase their monthly payment to lock in the fixed payment of a mortgage. This tends to be a short-term perspective that can have a staggering long-term effect for a person’s net worth. When you consider rents are increasing at historically high rates of over 13 percent in many areas it makes a lot of sense to lock in a monthly payment with a mortgage.”

There were 12 counties where it was more affordable to rent in 2015 that had been more affordable to buy in 2014. Those counties included Sacramento County, California; San Joaquin County, California in the Stockton metro area; Lancaster County, Pennsylvania; Spokane County, Washington; and Polk County, Iowa in the Des Moines metro area. Other markets switching from more affordable buyer markets in 2014 to more affordable renter markets in 2015 included counties in Reno, Nevada, Sarasota, Florida, St. Louis and Jacksonville, Florida.

For more information, visit www.realtytrac.com.