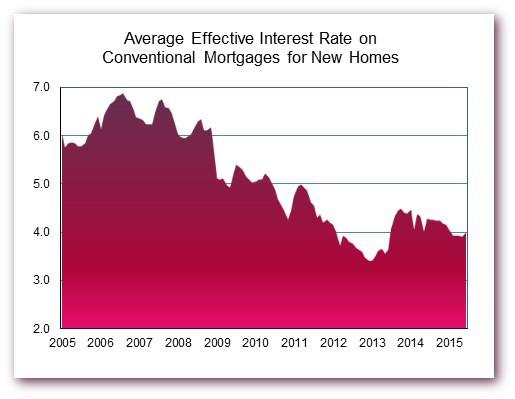

Interest rates on conventional mortgages used to buy newly built homes increased in June, according to data released earlier today by the Federal Housing Finance Agency (FHFA). The data show the average contract interest rate increasing by 9 basis points to 3.86 percent, the highest it’s been since January.

Interest rates on conventional mortgages used to buy newly built homes increased in June, according to data released earlier today by the Federal Housing Finance Agency (FHFA). The data show the average contract interest rate increasing by 9 basis points to 3.86 percent, the highest it’s been since January.

The average initial fees and charges on the loans decreased by 3 basis points to 1.08 percent, but this small change was not enough to prevent the effective interest rate (which amortizes initial fees over the estimated life of the loan) from climbing to 3.98 percent. This also represents a 9 basis point increase from May, and is the highest the average effecting rate has been since January.

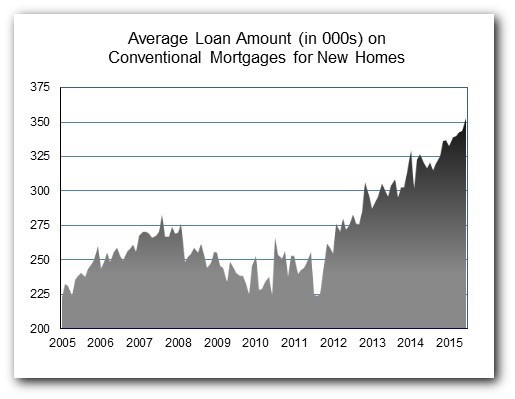

Meanwhile, the average size of the conventional mortgages used to purchase newly built homes increased for the fifth month in a row, from $343,000 in May to $352,500 in June. This is an all-time high and the first time the average loan amount has been above $350,000.

The average price of the newly built homes purchased with these loans actually increased by more than 3 percent in June, from $447,600 to $462,100. This also represents a record high, and marks the first time the average price of new homes purchased with conventional mortgages has been above $460,000.

The above information is based on FHFA’s Monthly Interest Rate Survey (MIRS) of loans closed during the last five working days in June. For other details about the survey, see the technical note at the end of FHFA’s July 30 news release.

View this original post on NAHB’s blog, Eye on Housing.