Existing-home sales steadily increased for the third consecutive month in July, while stubbornly low inventory levels and rising prices are likely to blame for sales to first-time buyers falling to their lowest share since January, according to the National Association of REALTORS®.

Existing-home sales steadily increased for the third consecutive month in July, while stubbornly low inventory levels and rising prices are likely to blame for sales to first-time buyers falling to their lowest share since January, according to the National Association of REALTORS®.

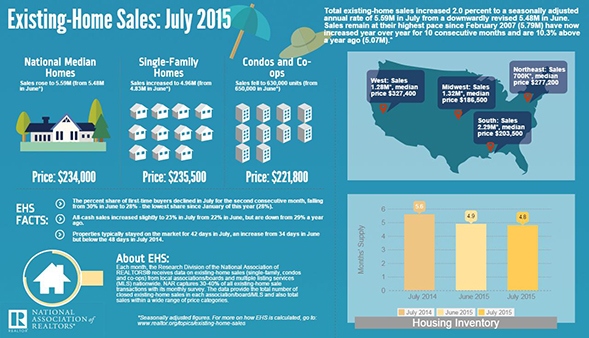

Total existing-home sales, which are completed transactions that include single-family homes, townhomes, condominiums and co-ops, increased 2.0 percent to a seasonally adjusted annual rate of 5.59 million in July from a downwardly revised 5.48 million in June. Sales in July remained at the highest pace since February 2007 (5.79 million), have now increased year-over-year for ten consecutive months and are 10.3 percent above a year ago (5.07 million).

Lawrence Yun, NAR chief economist, says the increase in sales in July solidifies what has been an impressive growth in activity during this year’s peak buying season. “The creation of jobs added at a steady clip and the prospect of higher mortgage rates and home prices down the road is encouraging more households to buy now,” he says. “As a result, current homeowners are using their increasing housing equity towards the down payment on their next purchase.”

The median existing-home price for all housing types in July was $234,000, which is 5.6 percent above July 2014. July’s price increase marks the 41st consecutive month of year-over-year gains.

“Despite the strong growth in sales since this spring, declining affordability could begin to slowly dampen demand,” adds Yun. “REALTORS® in some markets reported slower foot traffic in July in part because of low inventory and concerns about the continued rise in home prices without commensurate income gains.”

Total housing inventory at the end of July declined 0.4 percent to 2.24 million existing homes available for sale, and is now 4.7 percent lower than a year ago (2.35 million). Unsold inventory is at a 4.8-month supply at the current sales pace, down from 4.9 months in June.

The percent share of first-time buyers declined in July for the second consecutive month, falling from 30 percent in June to 28 percent – the lowest share since January of this year (also 28 percent). A year ago, first-time buyers represented 29 percent of all buyers.

“The fact that first-time buyers represented a lower share of the market compared to a year ago even though sales are considerably higher is indicative of the challenges many young adults continue to face,” adds Yun. “Rising rents and flat wage growth make it difficult for many to save for a down payment, and the dearth of supply in affordable price ranges is limiting their options.”

According to Freddie Mac, the average commitment rate for a 30-year, conventional, fixed-rate mortgage climbed to 4.05 percent in July from 3.98 percent in June – the first time above 4 percent since November 2014 (4.00 percent) and the highest since September 2014 (4.16 percent).

Properties typically stayed on the market for 42 days in July, an increase from June (34 days) but below the 48 days in July 2014. Short sales were on the market the longest at a median of 135 days in July, while foreclosures sold in 49 days and non-distressed homes took 41 days. Forty-three percent of homes sold in July were on the market for less than a month.

All-cash sales increased slightly to 23 percent of transactions in July (22 percent in June) but are down from 29 percent a year ago. Individual investors, who account for many cash sales, purchased 13 percent of homes in July, up from 12 percent in June but down from 16 percent in July 2014. Sixty-four percent of investors paid cash in July.

Representing the lowest share since NAR began tracking in October 2008, distressed sales – foreclosures and short sales – declined to 7 percent in July from 8 percent in June; they were 9 percent a year ago. Five percent of July sales were foreclosures and 2 percent were short sales. Foreclosures sold for an average discount of 17 percent below market value in July (15 percent in June), while short sales were discounted 12 percent (18 percent in June).

NAR President Chris Polychron says the housing market is in a much better place and has come a long way since the depths of the recession. “Five years ago, distressed sales represented 33 percent of the market in July,” he says. “For many previously distressed homeowners throughout the country, rising home values in recent years have helped recover equity and the vast improvement in several local job markets means fewer are falling behind on their mortgage payments.”

Single-family and Condo/Co-op Sales

Single-family home sales increased 2.7 percent to a seasonally adjusted annual rate of 4.96 million in July (highest since February 2007 at 5.08 million) from 4.83 million in June, and are now 11.0 percent above the 4.47 million pace a year ago. The median existing single-family home price was $235,500 in July, up 5.8 percent from July 2014.

Existing condominium and co-op sales fell 3.1 percent to a seasonally adjusted annual rate of 630,000 units in July from 650,000 units in June, but are still up 5.0 percent from July 2014 (600,000 units). The median existing condo price was $221,800 in July, which is 3.2 percent above a year ago.

Regional Breakdown

July existing-home sales in the Northeast decreased 2.8 percent to an annual rate of 700,000, but are still 9.4 percent above a year ago. The median price in the Northeast was $277,200, which is 1.3 percent higher than July 2014.

In the Midwest, existing-home sales were at an annual rate of 1.32 million in July, unchanged from June and 10.9 percent above July 2014. The median price in the Midwest was $186,500, up 6.6 percent from a year ago.

Existing-home sales in the South increased 4.1 percent to an annual rate of 2.29 million in July, and are 9.6 percent above July 2014. The median price in the South was $203,500, up 7.0 percent from a year ago.

Existing-home sales in the West rose 3.2 percent to an annual rate of 1.28 million in July, and are 11.3 percent above a year ago. The median price in the West was $327,400, which is 8.4 percent above July 2014.

For more information, visit www.realtor.org.