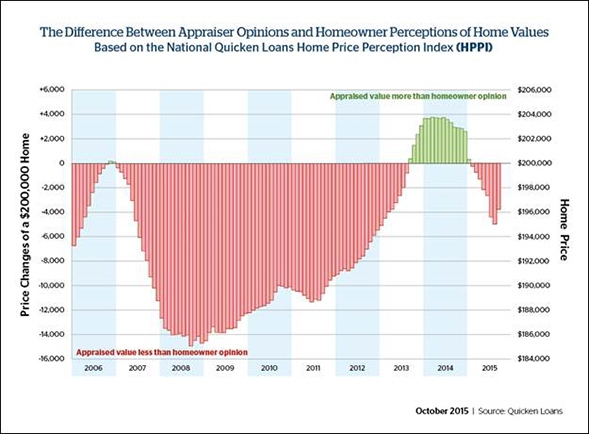

Appraiser opinions of home values in September were 2 percent lower than homeowner’s views, according to Quicken Loans’ national Home Price Perception Index (HPPI). The gap between the two values narrowed in September compared to the previous month, although the findings marked the eighth consecutive month homeowner estimates outpaced appraiser opinions.

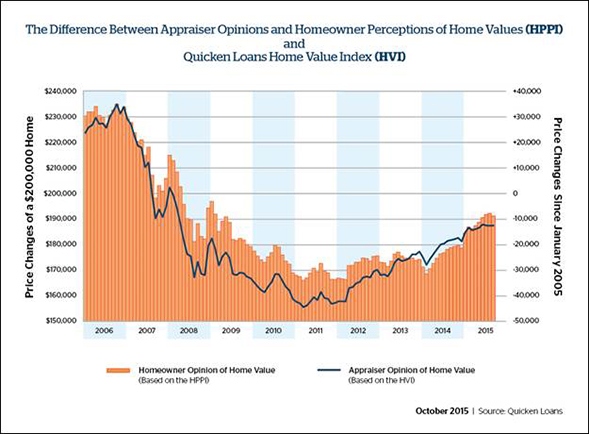

Average home values across the nation remained practically flat. Home values increased 0.05 percent in September, according to the national Quicken Loans Home Value Index (HVI). This makes up for the 0.05 percent loss in home values in August. Home values are still making steady annual increases, with 3.11 percent gain compared to September 2014.

Home Price Perception Index (HPPI)

The trend of homeowners estimating their property’s value higher than the actual appraised value continued in September. Nationally, appraiser opinions were an average of 2 percent below the values supplied by the homeowner. This is an improvement from August, when appraisals were 2.65 percent below what was expected by the homeowner. The HPPI has been falling, indicating appraised values lower than homeowner estimates, since its peak in June 2014. The September 2015 report marks the eighth consecutive month appraiser valuations were lower than what homeowners anticipated.

“It may not seem like homeowners assuming their home’s value is 2 percent higher than appraisers’ opinions is significant, but it could make a huge difference in metro areas with higher average home values,” says Quicken Loans Chief Economist Bob Walters. “It could also cause complications for homeowners looking to refinance who may be close to the loan-to-value thresholds to qualify or for those looking to eliminate mortgage insurance. We encourage consumers to stay aware of sales prices on comparable homes in their area to have a better idea of their home’s value.”

Home Value Index (HVI)

Home values across the U.S. have remained largely unchanged from the previous month. According the national Home Value Index (HVI), home values increased 0.05 percent in September. This negated the 0.05 percent loss reported in August. There has been a 3.11 percent increase in the national average of home values compared to last year. The pace of the increase in September was slightly lower than in August, when the study showed 3.24 percent annual growth. Regionally, the West posted the largest gains, with 0.72 percent monthly and 6.03 percent annual increases. The Northeast and Midwest regions posted both monthly and annual home value losses.

“I don’t think it’s a coincidence the West is showing the greatest home value increases with almost all of the western cities measured in the HPPI exhibiting appraiser opinions higher than homeowner estimates,” Walters continued. “Homeowners are hearing national reports of slower home value increases, or even drops in value, when that isn’t the case everywhere. Appraisals are telling a different story in many western cities but homeowners may not realize home values are still making such strides.”

For more information, click here.