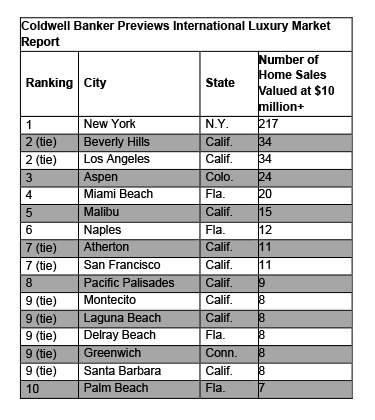

Four exclusive residential communities have cracked the “Top 20” list of cities with the highest number of sales in the $10 million-plus category, according to the Luxury Market Report prepared by the Coldwell Banker Previews International® marketing program.

Driven by strong demand from high-net-worth (HNW) individuals and families, Montecito, Calif.; Delray Beach, Fla.; Palm Beach, Fla.; and Vail, Colo. joined longtime luxury leaders like Beverly Hills, Calif.; Miami Beach, Fla.; and Aspen, Colo. Aside from the Colorado ski resorts of Aspen and Vail, the $10 million-plus sales are concentrated in cities on the nation’s east and west coasts.

In the $1 million-plus category, Atlanta experienced a 70 percent gain in sales compared with 2014 – the largest jump in the 20 cities covered in the report. Million-dollar sales rose 23 percent in Los Angeles and 21 percent in Seattle, while Houston and Park City, Utah, were newcomers to the list. However, $1 million-plus sales may be leveling off in two traditionally hot markets – Miami, where demand is largely driven by wealthy international buyers, and San Francisco, whose market is driven by the technology sector.

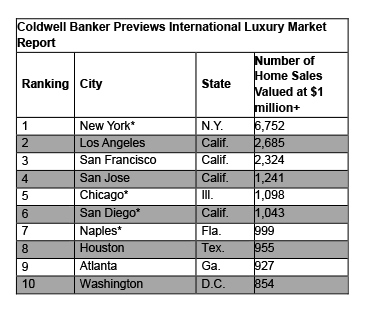

During the last 12 months through June 2015, the top 10 U.S. cities with the highest number of luxury home sales valued at $1 million+ are:

* The number of sales for these four cities is up by at least 36 percent.

In the range at $10 million and above category, Miami Beach and Aspen have steadily marched up towards longstanding luxury real estate epicenters New York, Beverly Hills and Los Angeles.

High-Net-Worth Consumer Survey

Rising home values are not dampening the interest of high-net-worth (HNW) individuals in making residential real estate investments in 2015, according to a companion survey of the wealthiest 1.5 percent of the U.S. population by Coldwell Banker Previews International® and Ipsos Connect. A 54 percent majority of HNW individuals say that they anticipate making an investment in real estate this year, up from 48 percent in 2014.

These findings offer insight behind the surging prices of high-end homes in many U.S. real estate markets over the last few years, including these key trends:

Home Ownership

• HNW individuals owned 2.1 homes on average

• Residential real estate comprised an average 38 percent of net worth

• 43 percent purchased residential real estate in the past five years

• 57 percent paid cash for their residential purchases

Investment Appeal

• 40 percent cited investment attractiveness as a reason to buy real estate

• 39 percent cited desire for a specific location

• 38 percent were seeking a safer investment than the stock market

• 31 percent wanted to take advantage of low interest rates

Generational Differences

Who plans to purchase a new property in the coming year?

• 69 percent of HNW Millennials under the age of 35

• 50 percent of GenXers (ages 35 to 49)

• 17 percent of Baby Boomers (ages 50 and older)

Who believes they have a choice of location for a “life anywhere” lifestyle?

• 85 percent of Millennials

• 69 percent of GenXers

• 29 percent of Baby Boomers

How much did they pay for their last home?

• Millennials spent an average of $4.96 million

• GenXers spent $5.24 million

• Baby Boomers spent $1.55 million

Preferred Amenities

• 43 percent want a home in “move in” condition

• 41 percent want a fully automated and wired home environment

• 36 percent want a LEED-certified green home

• 36 percent want open floor plans

• 34 percent want home gyms

• 32 percent want home theatres

• 30 percent want safe rooms

The full list of the Top 20 Best Performing U.S. Cities in Luxury Real Estate by price points of $1 million+, $5 million+ and $10 million+, and the high-net-worth consumer survey results can be viewed here: www.previewslmr.com.