The Bank of Mom and Dad is increasingly open for business – and is increasingly necessary for younger homebuyers looking to secure a down payment, particularly for middle-income households, presumed first-time homebuyers, Hispanics and Asians.

The Bank of Mom and Dad is increasingly open for business – and is increasingly necessary for younger homebuyers looking to secure a down payment, particularly for middle-income households, presumed first-time homebuyers, Hispanics and Asians.

We’ve been hearing anecdotally for some time that the combination of rising home values, slow income growth and still-tight credit markets has resulted in a growing reliance on intra-family loans and gifts meant to be used as down payments for younger home buyers. Now, data from the Federal Reserve Board’s 2014 Survey of Household Economics and Decisionmaking (SHED) helps confirm the stories.

The growing importance in the home-buying process of loans and gifts from family and friends underscores both the challenge that securing a suitable down payment represents for younger homebuyers, and their resourcefulness in finding ways to clear the down payment hurdle. The data also raise difficult questions around inequality in the housing market, as the lowest-income buyers likely needing the most help from family and friends to buy a home may not have access to the same kinds of social networks as their wealthier peers.

The SHED asks homeowners to identify the sources of the funds used for their down payment when they purchased their current home. There are five non-exclusive response options (homeowners can identify more than one source of funds):

- Proceeds from the sale of a previous home

- Personal savings

- A loan or gift from family or friends

- A second mortgage

- Financial assistance from a government program or non-profit organization.

Respondents are also given the option of indicating that no down payment was made.

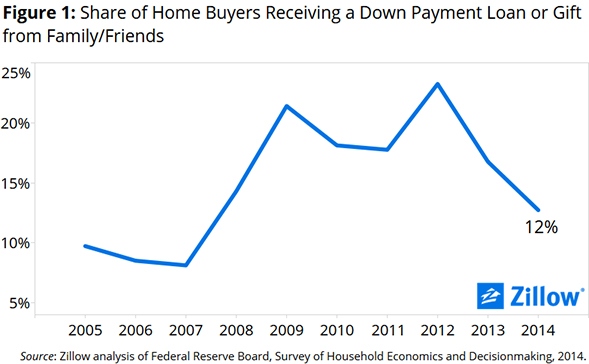

The use of loans and gifts from family and friends to help purchase a home increased sharply during the recession – from 8 percent of homes bought in 2007 to 21 percent of homes bought in 2009. The share has since declined, to 13 percent in 2014, but remains slightly above where it was prior to the recession (figure 1).

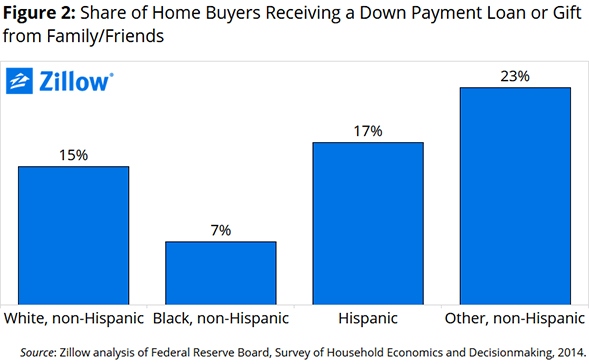

The reliance on down payment assistance from family and friends varies across racial and ethnic groups. Those falling into the “Other, non-Hispanic” grouping in the SHED data, presumably mostly Asians, have gotten the most help buying a home from their social networks over the past decade: 23 percent of these home buyers received a loan or gift from family or friends between 2005 and 2014. Hispanics also have a higher incidence of down payment assistance from social networks (17 percent) over the same time. Non-Hispanic blacks were least likely (7 percent) to report receiving down payment assistance from family and friends (figure 2).

By imputing household incomes using data from the American Community Survey (ACS), we are able to delve more deeply into the relationship between income, inequality, and the intergenerational transfer of economic privilege – with sometimes surprising results.

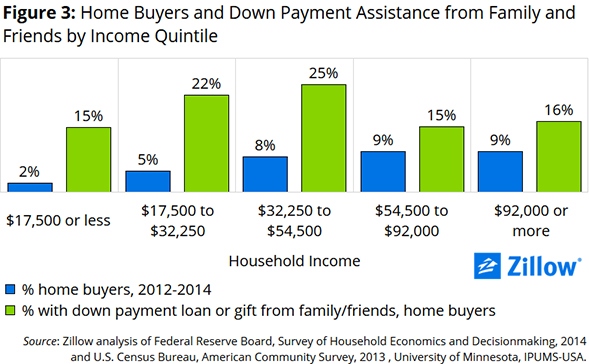

As expected, the lowest-income households are much less likely to buy homes: Only 2 percent of households in the bottom income quintile at the end of 2014 purchased a home during the previous three years, compared to 9 percent of households in the upper two income quintiles.

But among households that were able to buy a home, those in the middle of the income distribution were most likely to receive a down payment loan or gift from their family or friends: 25 percent of home buyers in the middle income quintile received a loan or gift from their social network to help fund their down payment, compared to 15 percent and 16 percent, respectively, in the lowest and highest income quintiles (figure 3).

This suggests that middle-income home buyers are the households most likely to both:

- Need help in funding a down payment

- Have social networks in place capable of providing assistance

Homebuyers at the bottom of the income distribution are likely less able to turn to family and friends for financial assistance, while home buyers at the top of the income distribution probably do not need assistance to the same degree as other buyers.

The SHED data cannot tell us if buyers are first-time homebuyers, but we can create two first-time homebuyer groups based on a few logical assumptions:

- A pre-recession cohort composed of young adults who purchased their current home between 2005 and 2007 when they were between the ages of 24 and 34, and who indicated that they did not rely on the proceeds from the sale of a previous home when making the down payment on their current home.

- A post-recession cohort composed of young adults who purchased their current home between 2012 and 2014 when they were between the ages of 24 and 34, and who also indicated that they did not rely on the proceeds from the sale of a previous home when making the down payment on their current home.

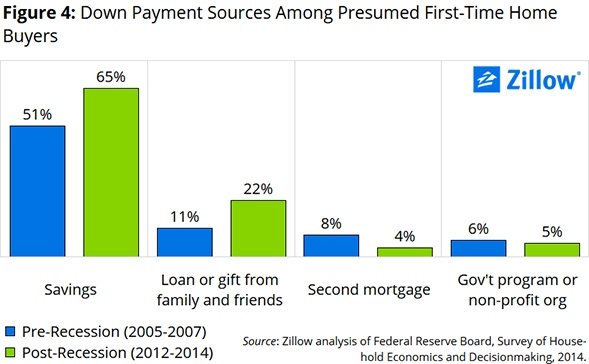

The results suggest that more first-time buyers are relying on down payment assistance from social networks today than a decade ago. Among the pre-recession cohort of presumed first-time home buyers, 11 percent received down payment assistance from their family or friends, compared to 22 percent for the post-recession group (figure 4). First-time homebuyers are also increasingly relying on personal savings, and less on second mortgages that were more common prior to the recession. The share relying on assistance from government or non-profit organizations has been essentially flat.

These data suggest that the Bank of Mom and Dad was particularly important for home buyers overall during the worst years of the recession. And gifts from family and friends have likely increased in importance among first-time homebuyers in more recent years, perhaps driven by high rents, still-tight credit availability, student loan debt and/or higher down payments as home values have increased. The reliance on down payment assistance from social networks appears to be particularly important for middle-income households, Hispanics and, very likely, Asians.

Aaron Terrazas is a Senior Economist at Zillow.

For more information, visit www.zillow.com.