Remarkably negative findings from the 2015 How Housing Matters survey released this week by the MacArthur Foundation were punctuated by two critically important findings. Attitudes on the value of housing as an excellent long term investment have flip-flopped and Millennials put a higher priority on the dream of homeownership than their elders.

Though the survey found that most Americans believe we are still in the middle of the housing crisis, the pendulum has swung back slightly toward the belief that homeownership is appealing and offers long-term benefits. Also, Millennials and African Americans still value homeownership more than the average American.

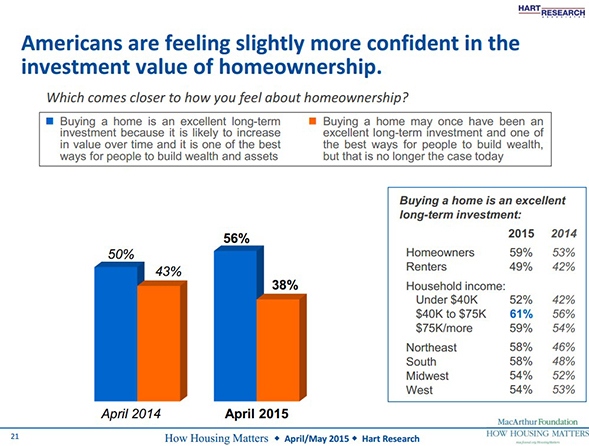

More than half, 56 percent, of adults say that buying a home is an excellent long-term investment compared to 38 percent who believe that buying a home is no longer an excellent long-term investment and one of the best ways for people to build wealth. This stands in contrast to the initial How Housing Matters survey in 2013 when a majority of the public (57 percent) says that buying a home was becoming less appealing.

More than Half of Millennials Place High Priority of Homeownership

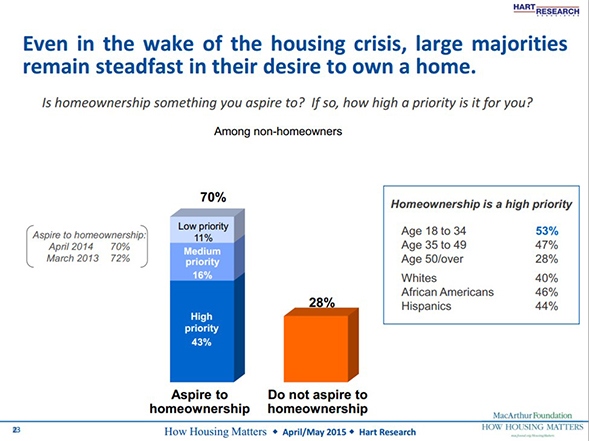

The proportion of non-homeowners who aspire to own a home remains constant at roughly seven in 10, with 43 percent of non-owners saying that homeownership is a fairly to very high priority. Millennials and African Americans prioritize homeownership at even higher rates, with 53 percent and 46 percent respectively saying that they place a very or fairly high priority on homeownership.

While Millennials are personally hopeful about their future prospects, the overwhelming majority of Americans today think it is harder for young people to achieve a secure middle-class lifestyle than it used to be. Americans as a whole perceive a tough road ahead for Millennials. Three in four (75 percent) believe achieving a middle-class lifestyle has become harder for young adults, and when it comes to key achievements associated with a middle-class lifestyle, vast majorities believe it will be harder for young people to save for retirement (81 percent), own a home (76 percent), secure a stable decent-paying job (71 percent), or have a stable affordable housing situation (71 percent) than it was a generation ago. While 88 percent of Millennials say they are optimistic about their future, including nearly half (48 percent) that are very optimistic, they expect a more challenging road ahead for their own generation, with significant majorities believing that being able to own a home (77 percent), save for retirement (76 percent), have a stable, affordable housing situation (69 percent), and have a decent-paying job (65 percent) will be harder for them than it was for previous generations.

Most Believe Housing Crisis is Not Over

Yet a significant majority of Americans believes the country is still not past the housing crisis that began seven years ago. Despite some improvement in their view of the housing situation nationally, the enduring sense of the housing market under pressure is reflected in the public feeling more worried and concerned than hopeful and confident about what the future holds for the country. Americans believe it is harder than it used to be to attain a secure middle-class lifestyle and significantly more likely for a family to fall from the middle class than to join it.

Americans believe the housing crisis continues, though that view is slowly receding. Three in five Americans (61 percent) believe we are either “still in the middle” of the housing crisis (41 percent) or “the worst is yet to come” (20 percent). While this is an improvement from 2014 (a combined 70 percent), and 2013 (77 percent), the persistence of such pessimism seven years after widespread mortgage defaults helped trigger a deep recession is an indicator of ongoing concerns about housing affordability as well as lingering economic trauma.

Perceived improvements in the housing situation nationally are not reflected in the public’s personal experiences or what they see happening in their own communities, as housing challenges persist at very high rates. Half of the public (55 percent) reports having had to make at least one sacrifice or tradeoff in the past three years in order to cover their rent or mortgage. One in five (21 percent) reports having to get an additional job or work more, 17 percent stopped saving for retirement, 14 percent accumulated credit card debt, and 12 percent cut back on healthy nutritious foods. The segments of the public having to make tradeoffs at the highest rates include renters (73 percent), racial minorities (68 percent of Hispanics and 62 percent of African Americans), Millennials (67 percent), and city dwellers (64 percent). Majorities of Americans continue to believe that it is challenging to find affordable rental housing in their own communities (58 percent in both 2014 and 2015), and housing to purchase (60 percent in 2015, 59 percent in 2014), and even more challenging for families at the median income (65 percent), young adults (80 percent), or families at the poverty level (89 percent).

Government Disconnect on Priorities

While the public overwhelmingly believes that housing affordability is a problem, the American people lack a clear vision of the role of the federal government and the kinds of policies it could enact that would substantially improve housing affordability in their communities. Eight in 10 Americans believe that housing affordability is a problem, with 60 percent characterizing it as a very (36 percent) or fairly (24 percent) serious problem, and this recognition transcends age, educational attainment, income, and even political party affiliation. A majority of Americans (55 percent) believe the federal government is more involved in housing-related issues today than it has been in the past two decades, and most (53 percent) say that addressing housing affordability is not its responsibility (39 percent say it is.)

Still, there is a disconnect between the level of priority housing issues receive from government and the degree of priority the American people would like to see their elected leaders place on housing related policy issues. Half of all adults express the desire for their elected officials in Washington to treat housing affordability as a very (27 percent) or fairly (22 percent) high priority. More than half (55 percent) would like to see their state and local elected leaders treat housing affordability as a very (30 percent) or fairly (25 percent) high priority. Yet only 14 percent believe elected officials in Washington or in their localities treat housing affordability as a high priority. The survey also shows that the public finds several empirically based messages to be very convincing evidence that government should be doing more to provide decent, affordable housing opportunities for families and communities.

“Most Americans do not believe the housing crisis is over, and this has contributed to the public feeling shaken in its optimism about what the future holds, particularly for younger people. The building blocks of success – having a good job, decent housing, and the ability to save for a secure future – are viewed as harder to achieve than they were a generation ago, and this in turn helps drive pessimism about social mobility. The idea that downward mobility is more likely today than upward mobility turns the American Dream on its head, and is an indicator of how badly confidence has been eroded,” says Geoffrey Garin, President of Hart Research Associates.

The 2015 How Housing Matters survey is the third annual national survey of housing attitudes conducted by Hart Research Associates and commissioned by the MacArthur Foundation. Hart Research Associates interviewed 1401 adults, including landlines and cell phones, between April 27 and May 5.

For more information, visit http://www.realestateeconomywatch.com.