According to the Household Debt and Credit Report released by the Federal Reserve Bank of New York, the outstanding amount of housing-related debt, both home mortgages and home equity lines of credit (HELOCs), totaled $8.8 trillion in the second quarter of 2016, 2.6 percent ($225 billion) greater than the level from one year ago.

However, the outstanding amount of home equity lines of credit declined by 4.2 percent, $21 billion, over the year to $478 billion. This is the 26th consecutive quarter of annual declines. Over this period, HELOCs have shrunk by 32.3 percent. In contrast, home mortgage debt rose over the year by 3.0 percent, $246 billion. The second quarter of 2016 marks the 11th consecutive quarter of annual growth. Over this period home mortgage debt has risen by 5.9 percent, but remains 10.0 percent below its pre-recession peak level.

The FRB NY’s measure of mortgage debt outstanding, which is comparable to home mortgage debt in the Flow of Funds, continues to rise. Additionally, a previous post documented the growth in multifamily residential debt outstanding. In sum, residential mortgage debt outstanding is growing.

On bank balance sheets, residential mortgage debt has different risk weights. The various risk weights were recently enacted by the Basel III regulations and they require banks to maintain a capital buffer to safely overcome downturns. The capital required is directly related to the level of risk a residential mortgage is presumed to present. The Basel III regulations went into effect on January 1, 2015 and banks were required to provide information through the Call Reports, on their residential mortgage exposures, 1-4 family and multifamily, beginning with the first quarter of 2015.

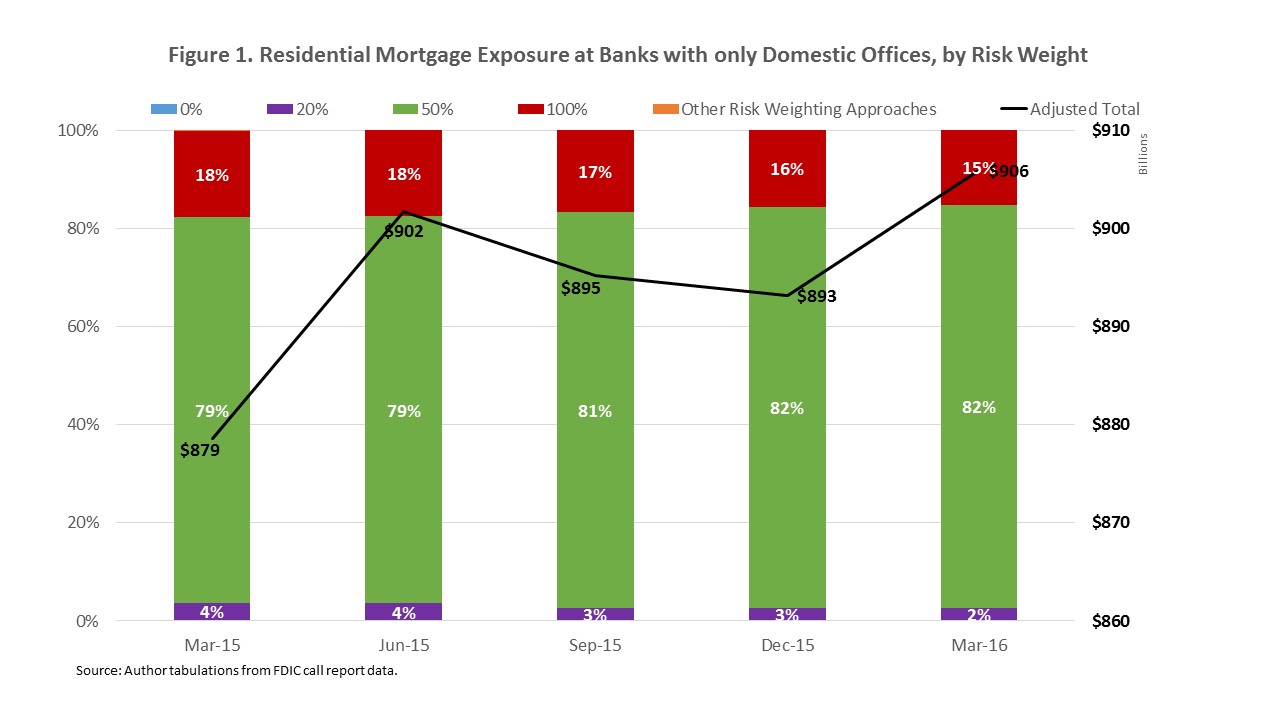

Figure 1 above shows the total and distribution of residential mortgage exposure, both the amount held for sale and the amount of loans and leases, for banks with only domestic offices. According to the chart there was an adjusted total of $879 billion in residential mortgage exposure in the first quarter of 2015. The amount of residential mortgage exposure rose in the second quarter before dipping over the next two quarters. However, in the first quarter of 2016, the amount of residential mortgage exposure reached $906 billion.

In the first quarter of 2015, the majority of the residential mortgage exposure, 79 percent, had a 50 percent risk weight while 18 percent had a risk weight of 100 percent and 4 percent had a risk weight of 20 percent. Over the past year for banks with domestic offices only, the share of residential mortgage exposure requiring a risk weight of 50 percent has widened at the expense of residential mortgages requiring either a 100 percent risk weight or a 20 percent risk weight.

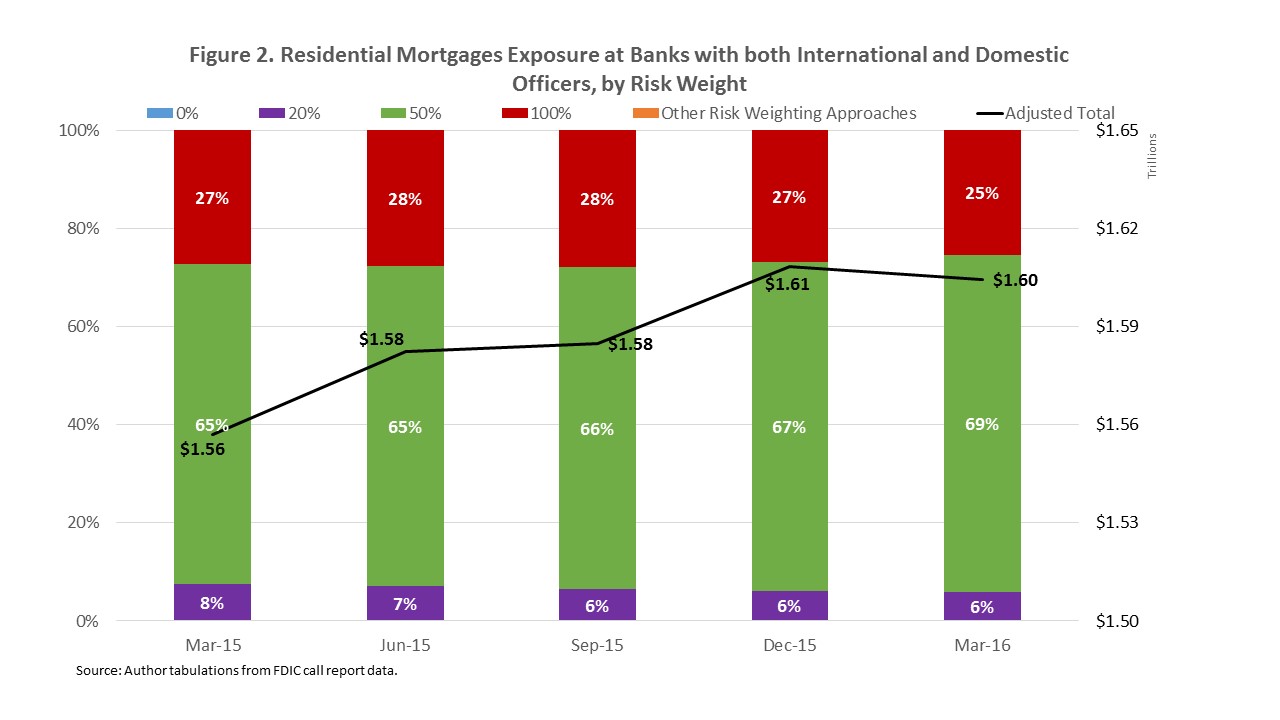

Figure 2 presents the total amount and the distribution of residential mortgage exposure for banks with both domestic and foreign offices across the entire consolidated bank and not just at domestic offices. According to the graph above there was an adjusted total of $1.56 trillion in residential mortgage exposure in the first quarter of 2015. The amount of residential mortgage exposure climbed steadily over the next 3 quarters before a modest decline in the first quarter of 2016.

In the first quarter of 2015, the majority of the residential mortgage exposure, 65 percent, had a risk weight of 50 percent. However, the proportion of residential mortgages overall with a risk weight of 50 percent at banks with both domestic and international offices was less than the share at banks with only domestic offices. Conversely, a greater percentage of residential mortgage exposure had a risk weight of either 100 percent or 20 percent. Nevertheless, the trend has been the same, the portion of residential mortgages with a 50 percent risk weighting has grown through the first quarter of 2016, while those with a 20 percent or 100 percent risk weighting have shrunk.

This post was originally published on NAHB’s blog, Eye on Housing.