Appreciating home values and rising interest rates inflated the typical monthly mortgage payment $68 in 2016, up to $758, according to a recent analysis by Zillow, with approximately 16 percent of the median household income now needed for housing each month—the biggest share since 2010.

“As mortgage rates rise, buyers will face higher financing costs and already expensive homes will come with even higher monthly mortgage payments,” says Dr. Svenja Gudell, Zillow chief economist. “Nationally, mortgage rates still have room to grow before the share of income needed to pay the median monthly mortgage reaches the historical average, but many more expensive coastal markets are either close to or have exceeded what has been considered historically affordable.”

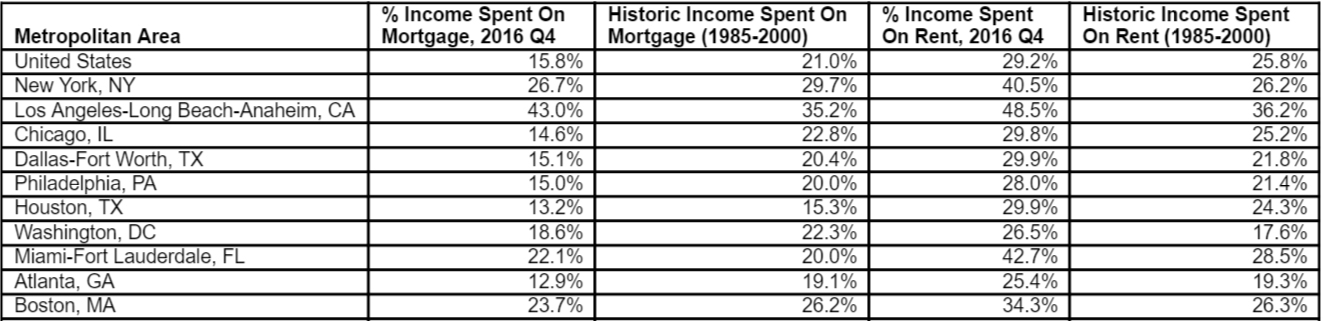

Housing costs in the Los Angeles-Long Beach-Anaheim, San Jose and San Francisco, Calif., markets gobble up the biggest pieces of the pie: 43.0 percent, 42.6 percent, and 42.2 percent of the median household income, in order. Historically, housing in Los Angeles called for 35.2 percent of the median income.

Housing costs in the Indianapolis, Ind., and Pittsburgh, Pa., markets take the smallest share: 11.2 percent of the median household income.

Approximately 29 percent of the median household income is now needed for rent each month, according to the analysis.

“On the rental side, rent appreciation has slowed lately, giving renters’ incomes a chance to catch up, as many are already committing a larger share of their income to a monthly rental payment,” Gudell says.

The markets with rental costs comprising the biggest share of the median household income are Los Angeles-Long Beach-Anaheim and San Francisco, Calif., and New York, N.Y., at 48.5 percent, 43.8 percent and 40.5 percent, in order.

Housing and rental costs in the top metropolitan areas:

For more information, please visit www.zillow.com.

For the latest real estate news and trends, bookmark RISMedia.com.