The homeownership rate in the U.S. has taken a nosedive since the early 2000s—and the economic impacts of the decline are staggering.

According to recent report by the Rosen Consulting Group (RCG), the economy lost over $300 billion, or 1.8 percent of GDP, as a result of subpar homebuilding in 2016. Household-related spending—averaging 18.9 percent of GDP since 1959—dropped to just 15.6 percent of GDP, while new-home construction spending fell to 3.6 percent of GDP, down from a 5.3 percent average since 1959.

Last year’s downtrends have been in the making since the recession. Over 9.4 million homes were lost to foreclosure from 2007 to 2015; today, many mortgage lenders are overcompensating to avoid a similar outcome, denying loans to applicants with credit scores as high as 700, the report shows. In 2016, the median credit score was 760—a sharp incline from 707 in 2006.

The immense student debt burden has also played a role by limiting homeownership to only those who can afford both a mortgage (including a down payment) and student loan payments, according to the report. Student debt has ballooned to $1.3 trillion since 2004.

Along a related vein, renters have had to contend with rising rents and stagnant wages instead of prioritizing saving for a down payment. More than three million renters now allocate over 30 percent of their income toward rent.

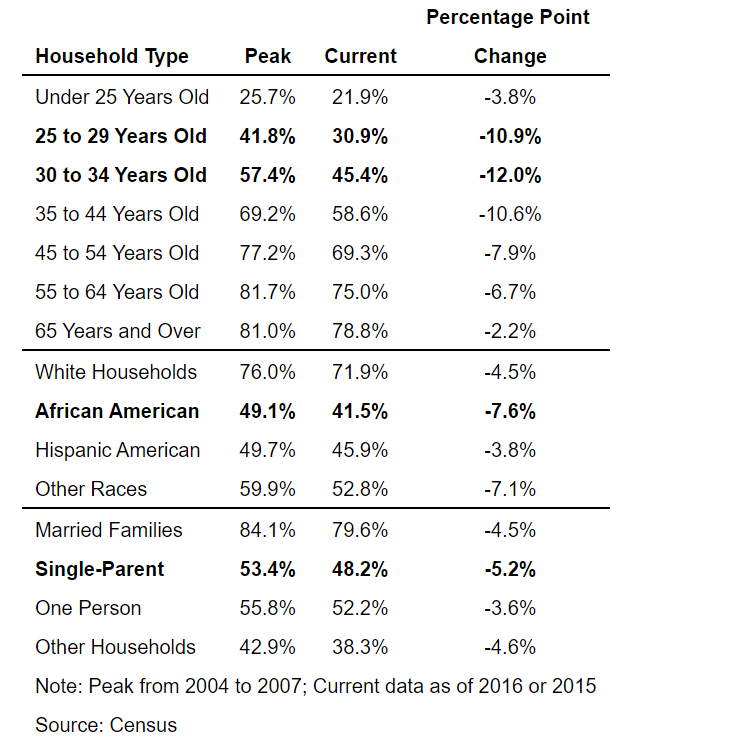

The lowest homeownership rates are among African-American, single person and young adult households, according to the report. The African-American homeownership rate shrunk to 41.5 percent in 2016, down from its peak by 7.6 percentage points; the single person homeownership rate was 48.2 percent in 2015, 31 percentage points below that of married households; and the young adult homeownership rate was 30.9 percent in 2016, down 10.9 percentage points.

All is not doom and gloom, however. Many of these trends are set to level out as the economy makes gains in employment and wages. The current homeownership rate, according to the report, could reverse course—but only if affordability is addressed.

The report, “Homeownership in Crisis: Where Are We Now?” was prepared for the National Association of REALTORS® (NAR) and released by Rosen Consulting Group and the Fisher Center for Real Estate and Urban Economics at the University of California – Berkeley.

Source: Rosen Consulting Group

For the latest real estate news and trends, bookmark RISMedia.com.