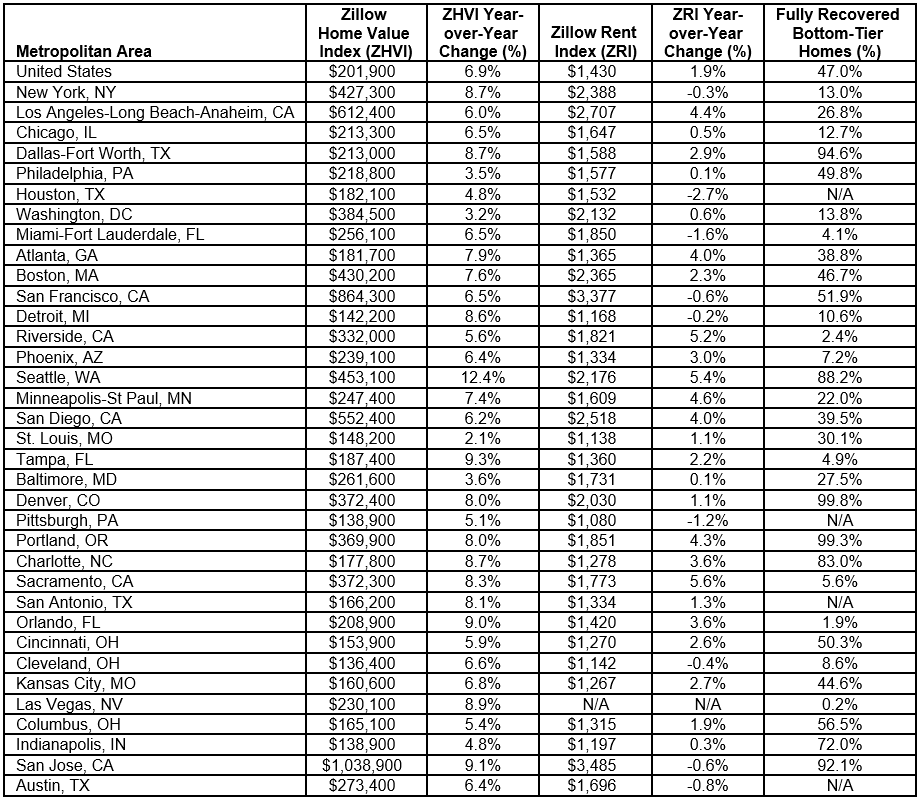

Entry-level homes came in last in the recession, hit hard by sinking values—and now, they are the last to recover, according to the August Zillow® Real Estate Market Reports. Starter homes in 24 of the 35 largest metropolitan areas, or roughly 69 percent, are struggling to regain value, even with the national median value up 6.9 percent year-over-year.

“The housing market as a whole is moving at a steady clip, with high demand and low inventory combining to maintain strong home value appreciation,” says Dr. Svenja Gudell, chief economist at Zillow. “Most new construction has been at the higher end of the market, so demand for the limited supply of entry-level homes is pushing up their values—but these homes also lost more value when the bubble burst. Many of these homeowners are still waiting to see their homes come back to where they were about 10 years ago. Even as headline numbers show an overall recovery, there are still thousands of Americans struggling to bounce back from the housing bust.”

Over 50 percent of homes nationwide, however, have recovered—and then some. In August, the national median value in the Zillow Home Value Index (ZHVI) was $201,900.

There are now 12.6 percent fewer homes for sale compared to one year ago, the Reports show. The national median rent in the Zillow Rent Index (ZRI), meanwhile, has posted an annual gain of 1.9 percent, with the median rent totaling $1,430.

For more information, please visit www.zillow.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com.

For the latest real estate news and trends, bookmark RISMedia.com.