Affordability is fading fast—and although millennials are eager to enter the market, and succeeding, they’re bearing the brunt of the challenge, according to recent research.

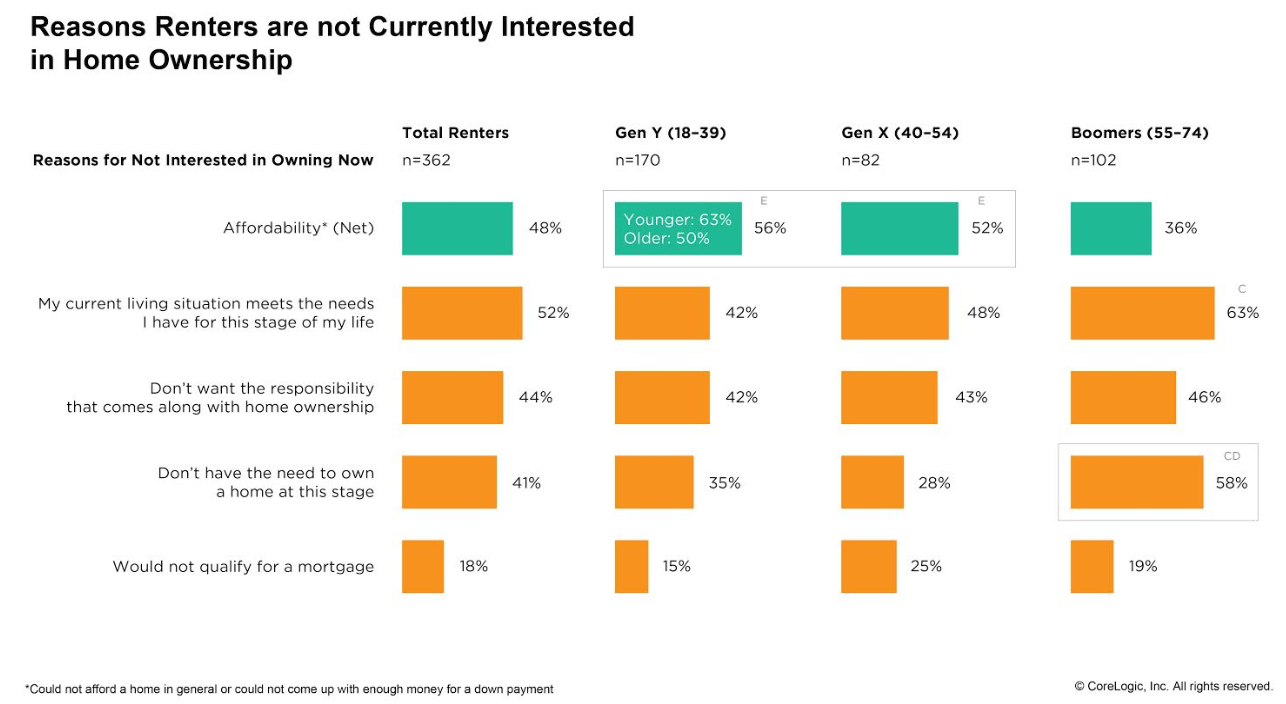

Sixty-three percent of millennials under 29 are challenged by the cost of homeownership, according to a CoreLogic and RTi Research study. The expense, in fact, is their No. 1 reason for remaining a renter.

“One-third of millennial renters reported feeling they cannot afford a down payment to buy a home,” says Frank Martell, CEO/president of CoreLogic. “With home prices rising quickly over the past few years and supplies low, first-time homebuyers face ever-growing challenges to find and buy affordable entry-level homes.”

According to CoreLogic’s June Home Price Index, prices rose 0.7 percent month-over-month and 6.8 percent year-over-year. Despite existing inventory in June perking up, demand keeps streaming in, and the imbalance is taking a toll.

Additionally, affordability is beginning to encumber sales, says Dr. Frank Nothaft, chief economist at CoreLogic.

“The rise in home prices and interest rates over the past year have eroded affordability and are beginning to slow existing-home sales in some markets,” Nothaft says. “Further increases in home prices and mortgage rates over the next year will likely dampen sales and home price growth.”

The findings are in line with the results of several studies this year, including one by Freddie Mac which found that affordability challenges are contributing to a downtrend in households of young adults. In a separate study by Trulia, the top barriers to homeownership for millennials included the down payment and price.

“More needs to be done to help our first-time buyers join the homeownership class,” Martell says.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com. For the latest real estate news and trends, bookmark RISMedia.com.

Suzanne De Vita is RISMedia’s online news editor. Email her your real estate news ideas at sdevita@rismedia.com. For the latest real estate news and trends, bookmark RISMedia.com.