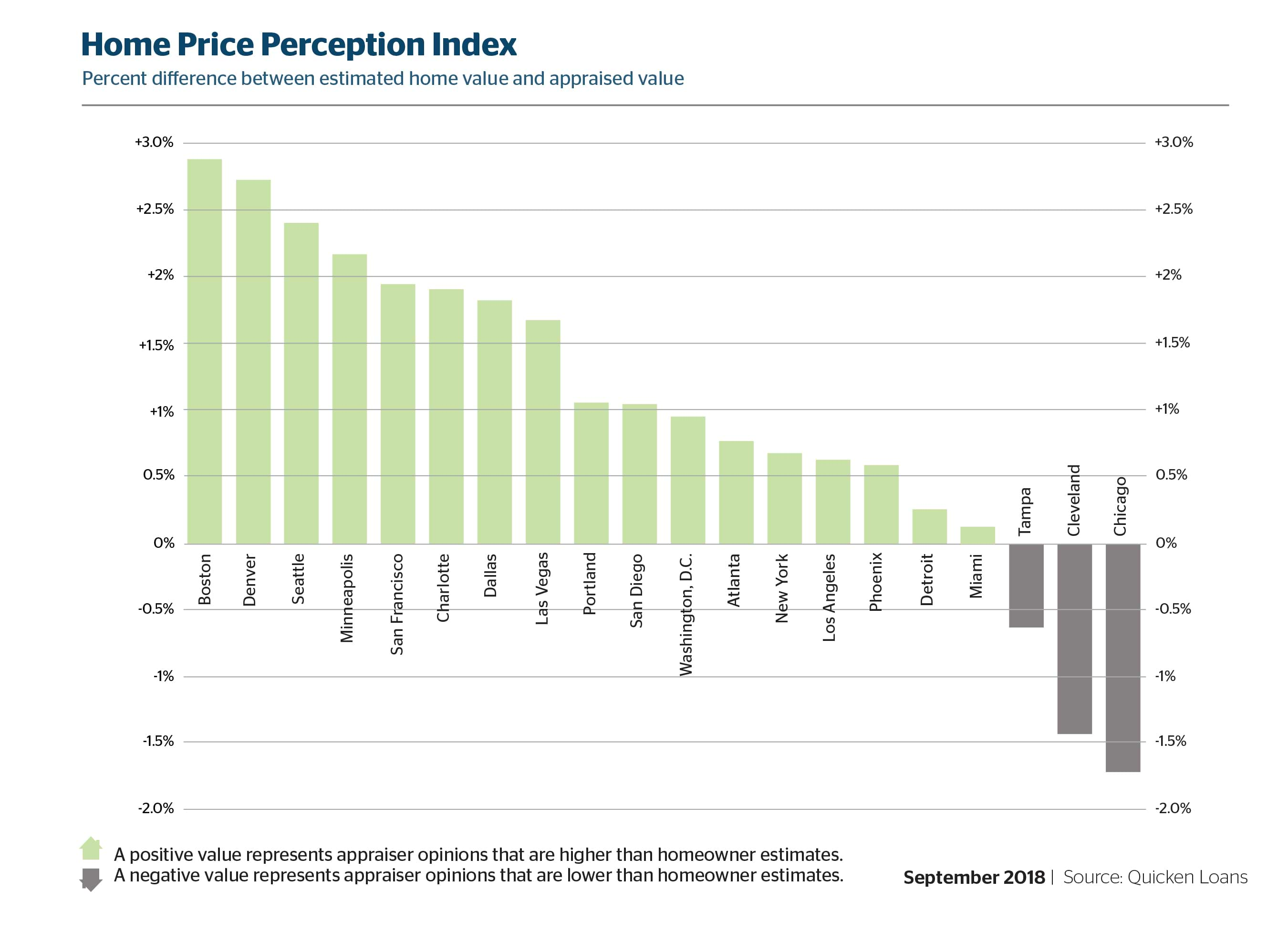

Appraisals in August were close to equal with what homeowners perceived was their property’s value, with appraisals only 0.28 percent under what was expected, according to the Quicken Loans National Home Price Perception Index (HPPI). Appraised home values rose 5.79 percent year-over-year, according to the Quicken Loans National Home Value Index (HVI).

“The variance in the HPPI across the country perfectly illustrates just how localized the real estate market is and how different it can be from one city to the next,” says Bill Banfield, executive vice president of Capital Markets at Quicken Loans. “It’s important for homeowners to look at their local housing market, and their home, objectively before estimating its value. Real estate experts can help them properly estimate their home’s value to make the process easier—whether they are selling, or refinancing.

“With the summer winding down, there were less ‘for sale’ signs on lawns across America, which left the buyers competing over these available houses and driving the prices up,” Banfield says. “We are all watching closely to see when more homes will be put up for sale, balancing the markets, because the demand for housing isn’t slowing down.”

For more information, please visit www.QuickenLoans.com/Indexes.

For the latest real estate news and trends, bookmark RISMedia.com.